Author: Go2Mars Web3 Research

Preface – The "Singularity" of Odyssey

Web3 incentive mechanisms are at a singularity moment, shifting from the "illusion of traffic" back to the "essence of value." Over the past few years, the Odyssey model has undergone a baptism from peak to bottleneck. We have found that simple model replication can no longer create ripples in the information-overloaded on-chain world.

1.1 Paradigm Shift: Why Do Most Projects' Odysseys Yield Meager Results?

Although the Odyssey model has created many wealth-making myths, by 2026, developers found that simply imitating the paths of leading projects could hardly produce a "breakout effect." This lack of effectiveness is essentially due to a deep fracture between incentive logic and the user ecosystem.

-

Incentive entropy increase has triggered severe homogenized involution

When 90% of projects in the market require users to repeat "cross-chain, staking, reposting" to obtain almost identical "Points," the marginal return on user attention plummets sharply. This model imitation leads to incentive entropy increase—the scarcity of rewards is diluted by a flood of homogenized projects. Taking Linea "The Surge" and the subsequent wave of L2 points wars as an example, when users find they need to move liquidity across dozens of protocols with highly similar logic only to receive constantly depreciating inflationary points, aesthetic fatigue evolves into "lying flat" in action, and the incentive effect is exhausted in endless involution.

-

Lack of game-theoretic mechanisms leads to "Sybil-style growth," creating massive false prosperity

Many project teams only learned the surface of the "task wall" but neglected the deep anti-Sybil game theory, resulting in most incentives being scooped up by automated scripts (Farmers) from professional studios. The experience of zkSync Era is a typical warning: although it boasted over 6 million active addresses on the books, data penetration revealed that the vast majority were mechanical interactions born to farm airdrops. This "paper prosperity" not only triggered a huge community governance crisis during the TGE stage but, more fatally, 90% of addresses quickly zeroed out after the airdrop landed. The project teams, apart from paying high customer acquisition costs, gained no real ecological沉淀 (sedimentation).

-

The "disconnect" between product logic and incentive interaction makes participation mechanical

The breakout effect often stems from the deep coupling of the product's core functionality and the reward mechanism. If Odyssey tasks become "on-chain hard labor" unrelated to the product's value (e.g., asking privacy protocol users to publicly shill on Twitter), users cannot develop brand identification. Just like early DeFi projects that强行捆绑 (forcibly bundled) social tasks on platforms like Galxe, although they gained tens of thousands of followers in a short time, this "demand mismatch" attracted mostly low-net-worth taskers, while真正的 (genuine) large-capital users churned away,反感 (repulsed) by this Web2-style forced interaction. Once the tasks ended, TVL (Total Value Locked) often experienced a cliff-like drop within 24 hours, failing to form any emotional resonance or competitive moat.

1.2 Defining Win-Win: Protocol Unit Economics (Unit Econom [truncated, likely "Economics"]

To break the death spiral of "poor results," the logic of win-win must shift from "buying traffic" to "building an ecosystem." We need to find the equilibrium point at the mathematical level:

1.2.1 Unit Marginal Revenue on the Protocol Side

Project teams must realize that the essence of an Odyssey is the precision of Customer Acquisition Cost (CAC)

UnitMargin = LTVuser − CACincentive

Only when the long-term fees, liquidity stickiness, or governance contributions generated by the user within the protocol (i.e., LTV - Lifetime Value) are greater than the rewards (Incentive) they receive, does the Odyssey cease to be mere "money sprinkling" and become sustainable capital expansion.

1.2.2 Total Utility Capture on the User Side

Users' pursuits in future Odysseys will be more rational. They will no longer be satisfied with Points that "might go to zero," but will calculate the comprehensive return rate:

-

Airdrop: Instantly monetizable token allocation.

-

Utility: Long-term protocol权益 (rights/equity) (e.g., lifetime fee减免 (rebates/discounts), RWA收益 (revenue) share).

-

Reputation: On-chain credit asset. This is the core credential for accessing future top-tier project "allowlist whitelists."

1.3 Core Hypothesis: Incentives Are Not Just Tokens, But a Complex of Credit, Privileges, and Revenue Rights

In deep incentive design, we completely overturn the old hypothesis that "ERC-20 tokens are the sole driving force." An Odyssey capable of producing a breakout effect must have value support in the following three dimensions:

-

Credit (Credit/Identity)

Permanently solidify user contributions through Soulbound Tokens (SBT) or on-chain identity systems. Credit is not just a medal; it is an efficiency multiplier: high-credit users can unlock "no-collateral lending" or "task weight bonuses," allowing genuine contributors to gain an advantage over scripts.

-

Privileges (Privileges/Utility)

Embed rewards into product usage rights. For example, Odyssey winners can obtain a "golden veto token" for protocol governance or "early mining priority rights" for other new projects within the ecosystem. Privileges turn users from "passersby" into the protocol's "long-term holders."

-

Revenue Rights (Revenue Rights/RWA)

With the advancement of compliance, the most attractive Odysseys in 2026 begin to incorporate underlying分红 (dividend/profit-sharing) logic. Rewards are no longer just inflationary air but are锚定 (anchored/pegged) to the protocol's real revenue (e.g., RWA government bond interest, DEX fee sharing). The injection of this Real Yield is the project's trump card for standing out amidst the泡沫 (bubble/froth) and achieving a true breakout.

2. User Behavior Genealogy: From "Airdrop Farmers" to "On-Chain Citizens"

In the future on-chain ecosystem, the traditional definition of "user" has disintegrated. With the popularization of Full Chain Abstraction and AI Agents, the souls (or algorithms) behind addresses exhibit extremely high differentiation. Understanding this genealogy is a prerequisite for designing win-win incentive mechanisms.

2.1. User Stratification Model: Deep Profiling Based on Motivation and Contribution

We divide Odyssey participants into three representative Greek letter strata. This stratification is no longer based solely on asset size (TVL) but on behavioral entropy and protocol loyalty.

2.1.1 Player Stratification

Gamma - Arbitrageurs (AI Bounty Hunters)

-

Role Definition: AI bounty hunters pursuing ultimate efficiency.

-

Psychological Motivation: Extremely rational. They have no interest in the project's sentiment; their only coordinate system is the "risk-free rate" and "certain returns."

-

Behavioral Manifestation: Typical script-driven interaction with extremely low latency. They move collectively like migratory birds in Gas fee洼地 (lowlands/depressions), with behavioral paths showing high standardization and homogeneity.

Beta - Explorers (Hardcore Players)

-

Role Definition: Hardcore players deeply involved in the ecosystem.

-

Psychological Motivation: Resonance-driven. They value deep product experience, community identity, and future long-term权益 (rights/benefits).

-

Behavioral Manifestation: Actively participate in deep feature beta testing, taking pride in obtaining scarce badges (SBT). They output high-quality feedback in the community, and their interaction轨迹 (trajectories) carry distinct personal characteristics and subjective preferences.

Alpha - Builders (Ecological Pillars)

-

Role Definition: The protocol's most fundamental support and interest community.

-

Psychological Motivation: Sovereignty-driven. Their goals are long-term governance rights, dividend rights, and building an impregnable security moat.

-

Behavioral Manifestation: Manifested as large-capital long-cycle lock-ups, submitting core code proposals, or running validator nodes. As stated in the text: "They do not produce noise; they only produce credit."

2.1.2 Behavioral Characteristics and Quantitative Models

-

Gamma's Survival Law: Ruthless cost estimation

For Gamma players, the Odyssey is a game of precise calculation. They don't care about the project vision, only the capital efficiency per unit time.

-

Alpha's Moat Effect: The博弈 of power (Game of power)

Alpha players disdain retweeting and liking on Twitter; their Odyssey is体现在 (embodied in) sovereign contributions. They are the protocol's "定海神针" (sea-calming needle/steadfast anchor), and the沉淀 (sedimentation) of their large assets and maintenance of technical nodes directly determine the protocol's market cap ceiling and risk resistance.

2.1.3 Identity Collapse and "Consensus Alchemy"

Identity is not终身制 (lifelong) but a dynamically evolving continuous spectrum. In excellent Odyssey designs, user identity undergoes a "quantum leap":

-

Leap from "Arbitrage" to "Exploration": A Gamma player whose initial intention was only to farm might be impressed by the protocol's极致 (ultimate/excellent) product experience or solid technical logic during deep interaction. When they discover that the收益 (benefit/return) of long-term holding is higher than the profit from immediate selling, they experience "identity collapse"—transforming from "finish and leave" to "deep holding."

-

The Project's "Consensus Capture Power": This leap is essentially the project team's "alchemy" performed on users. Low-quality projects can only attract and retain arbitrageurs, eventually collapsing with the exhaustion of incentives; whereas high-quality projects possess a centripetal force that can precipitate "bounty hunters" into "forest keepers."

Core Insight: The incentive mechanism is no longer a rigid divide-and-conquer but a process of screening, filtering, and transformation. It acknowledges the existential value of Gammas, but its ultimate mission is to use incentive leverage to induce users to complete the cross-level evolution from profit-seeking散户 (retail) to value partners.

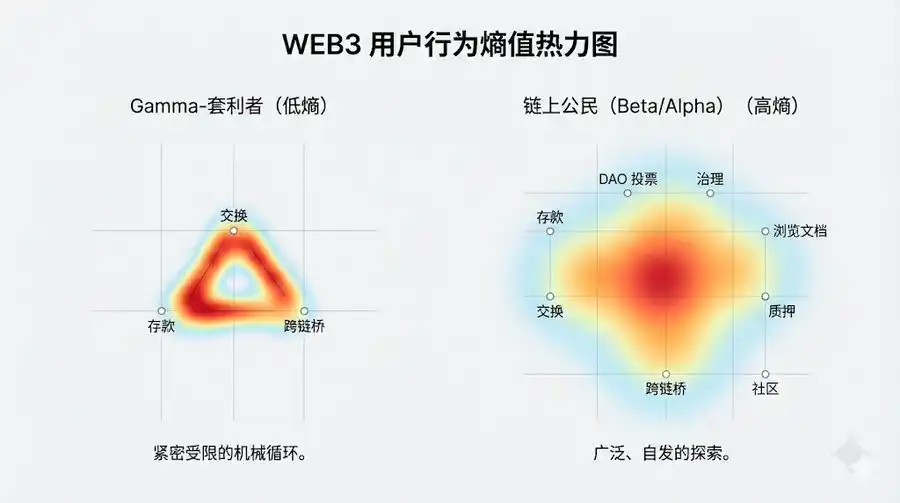

2.2 Behavioral Heatmap Analysis: Nonlinear Characteristics of Mainstream Layer 2 Task Completion Paths

Before 2024, Odyssey task paths were linear (Step 1: Follow Twitter; Step 2: Cross-chain; Step 3: Swap). But in the future, design based on "Intent-centric" principles will make user behavior heatmaps show significant nonlinear,网状 (network/mesh) characteristics.

2.2.1 Path Forking from "Task-Driven" to "Intent-Driven"

Through data mining on mainstream L2s like Arbitrum, Optimism, and Base, we found:

-

Path Non-Determinism: For the same Odyssey task, User A might complete it via "Lending -> Staking -> Minting," while User B might achieve it with one click via a "Full-Chain Aggregator -> Automatic Strategy Pool."

-

Cross-Chain Heat Anchor Points: Behavior is no longer confined to a single chain. User behavior on Layer 2 is often accompanied by immediate feedback on Layer 3 dedicated application chains. For example, 10 minutes after interacting on L2, the heatmap shows users quickly triggering automatic收益分配 (reward distribution) scripts on associated AI chains.

2.2.2 Non-Uniform Distribution of Behavioral Entropy

Monitoring data shows that high-quality users (Beta and Alpha strata) have behavior heatmaps with higher "complex entropy."

-

Gamma-Arbitrageurs' Heatmap: Shows highly mechanical regularity. Interaction points are concentrated within the minimum closed loop required by the task, with short and repetitive paths.

-

On-Chain Citizens' Heatmap: Shows dispersion and long-tail characteristics. Beyond completing the set Odyssey tasks, they also explore secondary pages of the protocol, read on-chain documented records, or interact with other dApps within the ecosystem.

Insight: The most successful Odyssey projects have heatmaps that are not a straight line but a gravitational field. They can吸引 (attract) users to spontaneously stay within the ecosystem and generate "unplanned" interactions after completing the既定 (set) tasks.

Users are no longer satisfied with being treated as a "wallet address." In Odyssey 3.0, the end of the behavior spectrum is "On-Chain Citizenship." This citizenship means not only reward distribution but also an identity endorsement in the multi-chain civilization.

3. Mechanism Design: Mathematical Models and Game-Theoretic Equilibrium Ensuring "Win-Win"

In the evolution history of Web3, early Odysseys were often criticized for falling into the "Ponzi僵局" (stalemate/impasse): project teams exchanged future inflationary expectations for current false prosperity. To escape this cycle, the core lies in achieving Incentive Compatibility (IC). This means we need to ensure, through rigorous mathematical models, that the path where users pursue their own利益最大化 (benefit maximization) completely overlaps with the path for the protocol's long-term healthy development.

3.1 The Incentive Compatibility Equation (The IC Constraint): Restructuring the Game of Cost and Benefit

In traditional airdrop models, the marginal cost of Sybil Attack was almost zero. To protect the interests of genuine contributors from dilution, future Odyssey designs introduce IC constraint equations based on game theory.

Core Game Theory Model

Let R(c) be the comprehensive reward obtained by an honest user for genuine interaction, and C(c) be the hard costs incurred (including Gas, slippage, capital opportunity cost, etc.). Simultaneously, let E[R(s)] be the expected收益 (reward/return) obtained by a Sybil attacker simulating interaction via automated scripts, and C(s) be their attack cost (including servers, IP pools, anti-detection algorithms, and sunk costs after being purged).

The Nash Equilibrium point for achieving win-win must satisfy:

[Note: The original text seems to have a formatting issue here, likely intending to present an inequality like R(c) - C(c) > E[R(s)] - C(s) or similar]

Intervention and Evolution in the 2.0 Era:

-

Drastically Increase C(s) (Attack Resistance): Future defense layers no longer rely on simple blacklists but incorporate AI behavioral entropy detection. The system analyzes the spatiotemporal distribution of interactions, the关联熵 (correlation entropy) of fund paths, and the "human-likeness" of operations. For suspected accounts, the system dynamically implements a "Gas Fee Penalty Coefficient," forcing them to pay higher transaction fees during non-peak hours, directly destroying the script's unit profitability.

-

Deeply Optimize R(c) (Reward Structure): The reward pool shifts from "pure governance tokens" to "hybrid权益包" (rights/benefits packages). This includes: Cash Flow Rights: Direct distribution of protocol fee dividends (Real Yield). Privileged Assets: Permanent fee减免 (rebates) (Gas Rebate) or interest rate bonuses for cross-protocol lending. Governance Leverage: Governance weight bonuses for long-term holders, allowing "genuine participation" to generate not only wealth but also power.

3.2 Dynamic Difficulty Adjustment Mechanism (DDA)

Future Odysseys will no longer be a static task list. Learning from Bitcoin's difficulty adjustment algorithm, advanced protocols are beginning to implement Dynamic Difficulty Adjustment (DDA).

Operational Logic:

When the Odyssey enters an explosive phase, with the number of interactive addresses and Total Value Locked (TVL) surging sharply in a short time, the system automatically senses "overload heat." At this point, the points capture algorithm automatically triggers a difficulty increase:

-

Increasing Capital Thresholds: The interaction amount or liquidity lock-up period required to obtain the same points increases accordingly.

-

Upgrading Task Complexity: From simple "one-click Swap" to "multi-protocol combination strategies" (e.g., borrow on Protocol A, stake on Protocol B, provide hedging on Protocol C).

Win-Win Logic:

-

For the Protocol: DDA acts like a safety valve, preventing瞬时涌入的 (instantaneously flooding) speculative traffic from overwhelming the liquidity pool, avoiding a cliff-like collapse due to "reward exhaustion."

-

For Alpha-Citizens: It protects those early, stable builders. Because high-difficulty tasks naturally筛选掉 (filter out) "羊毛党" (wool-party/airdroppers) lacking professional capability, allowing the reward share to flow more accurately to high-net-worth genuine users.

3.3 Proof of Value Model (PoV)

In Odyssey 3.0, "address count" is彻底判定为 (completely judged as) a Vanity Metric. Project teams are comprehensively transitioning to the PoV model, whose core is measuring Contribution Density.

Contribution Density Formula:

We define contribution density D as:

D = ∑(Liquidity × Time) + γ × Governance_Activity / Total_Reward

-

Liquidity (Capital Stickiness): Measures the "sedimentation time" of user funds within the ecosystem, rather than "in and out."

-

gamma (Community Contribution Factor): This is a tuning variable. For users actively participating in governance voting, writing technical documentation, or generating genuine positive辐射 (radiation/influence) on social networks, the gamma bonus can reach 2x or even higher.

-

Total Rewards: Serves as the denominator, aiming to balance inflation and ensure the value per unit reward.

Deep Win-Win Analysis:

Through the PoV model, what project teams obtain is no longer a list of cold wallet addresses but a real图谱 (map/spectrum) of ecological participants. Users, in turn, discover that due to the gamma factor, their "labor," rather than单纯 (merely) "capital," can also yield extremely high returns. This mechanism achieves harmonious resonance between capital efficiency and human creativity, ensuring the Odyssey is no longer a "numbers game" but a process of genuine value co-creation.

4. Technological Pillars: ZK-Based Incentive Underlying Protocol with Behavioral Perception

In the future shift, the Odyssey is no longer a front-end "task wall" but an underlying protocol capable of automatically capturing, analyzing, and transforming user behavior. This protocol, through ZK technology and full-chain abstraction, constructs a closed loop from behavioral perception to precise incentives.

4.1 Behavioral Perception Engine: From "Passive Check-in" to "Full-Chain Behavior Tracking"

The core function of this protocol is to act as a full-chain data crawler and indexer. It no longer relies on users manually submitting task screenshots but automatically records users' deep interactions within DApps through underlying gateways.

-

Full-Dimensional Behavior Modeling: The protocol can抓取 (crawl/grab) in real-time the user's on-chain liquidity depth, transaction frequency, governance participation, and even dwell time on the product front-end (via zero-knowledge off-chain proofs).

-

Dynamic Weight Analysis: The protocol performs multi-dimensional modeling on these behaviors, analyzing whether the user is a "Long-Term Holder (HODLer)," "High-Frequency Liquidity Provider," or "Deep Governance Participant." This analysis based on genuine interaction evolves the Odyssey model from "mechanical tasks" to "behavioral medals."

4.2 ZK-Proof Driven Privacy-Preserving Analysis and Screening

After acquiring behavioral data, the protocol uses ZK-Proof (Zero-Knowledge Proof) technology to achieve precise screening without leaking user wallet details and private data (PII).

-

ZK-Credentials Credit Endorsement: Users don't need to "show their face" or expose asset details. Through this underlying protocol, users can present the project team with a "High Net Worth User Proof" or "Seasoned DeFi Player Proof" generated by the protocol.

-

Screening Effect and Anti-Sybil: The protocol allows project teams to set "advanced entry thresholds." For example, using ZK-STARKs to verify users' non-repetitive interactions over the past 180 days, generating a "Proof of Unique Real Human." This fundamentally locks out the space for automated scripts (Farmers), ensuring incentives only flow to real entities identified by the protocol as "high-quality behavior."

4.3 Intent-Oriented Full-Chain Abstracted Incentives (Intent-centric & Abstraction)

This protocol not only records behavior but also simplifies participation paths through an Intent Engine, achieving interaction-as-incentive.

-

Intent-Driven Automatic Interaction: Users only need to express the intent "I want to participate in this protocol's liquidity incentive," and the underlying protocol will automatically coordinate cross-chain asset transfers, Gas fee balancing, and contract calls.

-

Instant Conversion and Win-Win: This mode of "seamless interaction, automatic incentives" frees users from繁琐的 (cumbersome) on-chain steps; meanwhile, project teams, through the underlying protocol, capture the user's most genuine core intent, not only improving conversion rates but also allowing the Odyssey model to truly return to the product value itself.

5. Future Evolution – From "Marketing Campaign" to "Normalized Incentive Protocol"

Future Odysseys will completely bid farewell to their "time-limited" characteristics and evolve into a Native Incentive Layer resident at the protocol code level.

5.1 Embedded Incentives (GaaS: Growth-as-a-Service)

The Odyssey will no longer be a webpage but dynamic reward logic embedded within smart contracts.

-

Evolution: As long as users generate positive value for the protocol (e.g., reducing slippage, providing long-term liquidity), the contract will automatically recognize and distribute rewards in real-time. The Odyssey becomes the protocol's "autopilot mode."

5.2 Cross-Protocol "Credit Lego" (Interoperable Incentives)

Future Odyssey points will be portable. Your Odyssey performance in Lending Protocol A will be converted into an initial等级 (level/rank) in Social Protocol B via ZK proofs.

-

Ultimate Form: A universally applicable "On-Chain Contribution Score" across the entire ecosystem will replace fragmented points. This cross-protocol联动 (linkage/synergy) will facilitate the Web3 ecosystem's ultimate leap from "存量互割" (mutual harvesting of existing stock) to "增量共建" (co-building of new increments), achieving a truly global on-chain republic.

6. Practical Execution Guide (The Executive Playbook)

The Odyssey is no longer a "spray and pray" money-sprinkling game but an极其精密的 (extremely precise) ecological引流 (drainage/traffic acquisition) and capital solidification engineering. For project teams, the core of execution lies in balancing "explosiveness of traffic" and "resilience of the system." Below are 10 golden rules of execution and a practical framework to ensure a win-win situation.

6.1 Paradigm Shift in Core KPIs: From "Vanity" to "Hardcore"

Stop being fooled by Twitter follower counts and address numbers. In a future where intent engines can simulate millions of addresses at low cost, these metrics are极易造假 (extremely easy to fake).

-

Metric A: Sticking TVL (Sticky Capital Ratio). Calculation formula:

RetentionRatio = TVL_T+90 / TVL_Peak

If this ratio is below 20%, it indicates serious flaws in the incentive mechanism design.

-

Metric B: Net Contribution Score. Namely, the ratio of the total protocol fees generated by a single address to the incentive cost it received.

-

Metric C: Governance Activity Entropy Value. Measures the genuine participation depth of Odyssey users in Snapshot or on-chain proposals, not mere vote manipulation.

6.2 Modular Task Design: Building a Stepped "Funnel"

The most successful Odysseys typically adopt a "three-tier" architecture aimed at converting massive traffic into core citizens.

Base Layer (L1) – Icebreaking and Reach

-

Target Audience: New users / General Web3 players

-

Core Tasks: Complete basic interactions (e.g., one-click Swap, social sharing)

-

Incentive Structure: Award non-fungible badges (SBT), accumulate future airdrop points

-

Retention Logic: Extremely low barrier to entry. Establish the first point of contact via SBT, allowing users to leave a "digital footprint" in the ecosystem.

Growth Layer (L2) – Liquidity Engine

-

Target Audience: Active traders / Liquidity Providers (LPs)

-

Core Tasks: Deep liquidity provision,组合头寸 (portfolio) management, cross-chain staking

-

Incentive Structure: Protocol native token rewards, real-time fee discount cards

-

Retention Logic: Yield rate (APY)博弈 (game/play). Lock in funds through high-efficiency yields, artificially increasing the "opportunity cost" of withdrawal.

Ecosystem Layer (L3) – Core Sovereign Faction

-

Target Audience: Core contributors / Developers / Governance delegates

-

Core Tasks: Write technical documentation, submit code patches, initiate effective governance proposals

-

Incentive Structure: Governance weighting factor, RWA revenue分红权 (dividend rights), ecosystem whitelist

-

Retention Logic: Grant "Citizenship." Not just benefit distribution, but long-term interest alignment, making contributors owners of the ecosystem.

6.3 Execution Check-list (Must Read Before Launch)

-

Value Loop Check: Does the reward source include the protocol's own revenue (Real Yield)?

-

Anti-Sybil Depth: Is it integrated with ZK-ID or真人识别 (real person verification) systems (like World ID / Gitcoin Passport)?

-

Capital Stickiness: Do tasks require funds to stay within the protocol for more than 14 days?

-

Technical Redundancy: Can the protocol contracts withstand瞬时 (instantaneous) 100x the daily call volume?

-

Emotional Value: Does the task narrative have social传播属性 (virality/spreadability), rather than being merely "number moving"?

Conclusion – From "Game-Theoretic Confrontation" to "Value Symbiosis"

The Odyssey model is essentially a revolution in screening efficiency. When we introduce the "Incentive Compatibility Equation" and "Behavioral Entropy Analysis" in the text, the purpose is not only to defend against Sybil attacks but also to establish a precise value metric system within the decentralized anonymous network.

Under this new paradigm, project teams and users are no longer zero-sum game opponents. Through Dynamic Difficulty Adjustment (DDA) and the Proof of Value (PoV) model, we successfully transform单纯的 (mere) capital interaction into quantifiable contribution density. This transformation brings about a crucial byproduct – On-chain Credit.

Credit does not arise out of thin air; it is the "digital residue" precipitated by users through countless high-entropy interactions, long-term lock-ups, and governance participation. In the future ecosystem, the incentive mechanism will no longer be just a tool for distributing tokens but a furnace for casting credit. It allows every genuine effort to be remembered by the code, making "trustworthiness" a more稀缺的 (scarce) pass than capital.

Ultimately, the end of an Odyssey is not the conclusion of an airdrop but the starting point of the contractual relationship between the protocol and its citizens. When we use mathematics and technology to dispel the泡沫 of traffic, the solid credit foundation left behind is the fundamental guarantee for Web3's transition from a "speculative wasteland" to a "civilization of value."